JustWatch today released its latest report on the US streaming industry, following changes in the market throughout 2025. With more than 20 million monthly users in the United States alone, JustWatch shares unique insights into online viewing habits.

This Quarterly Market Shares Report tracks user behavior changes and highlights the wins and losses of over 300 SVOD providers in the United States.

İçerikler

- JustWatch today released its latest report on the US streaming industry, following changes in the market throughout 2025. With more than 20 million monthly users in the United States alone, JustWatch shares unique insights into online viewing habits.

- Key Takeaways:

- Market Development Snapshot

- SVOD Market Shares in Q4 2025

- Market Development Overview

Key Takeaways:

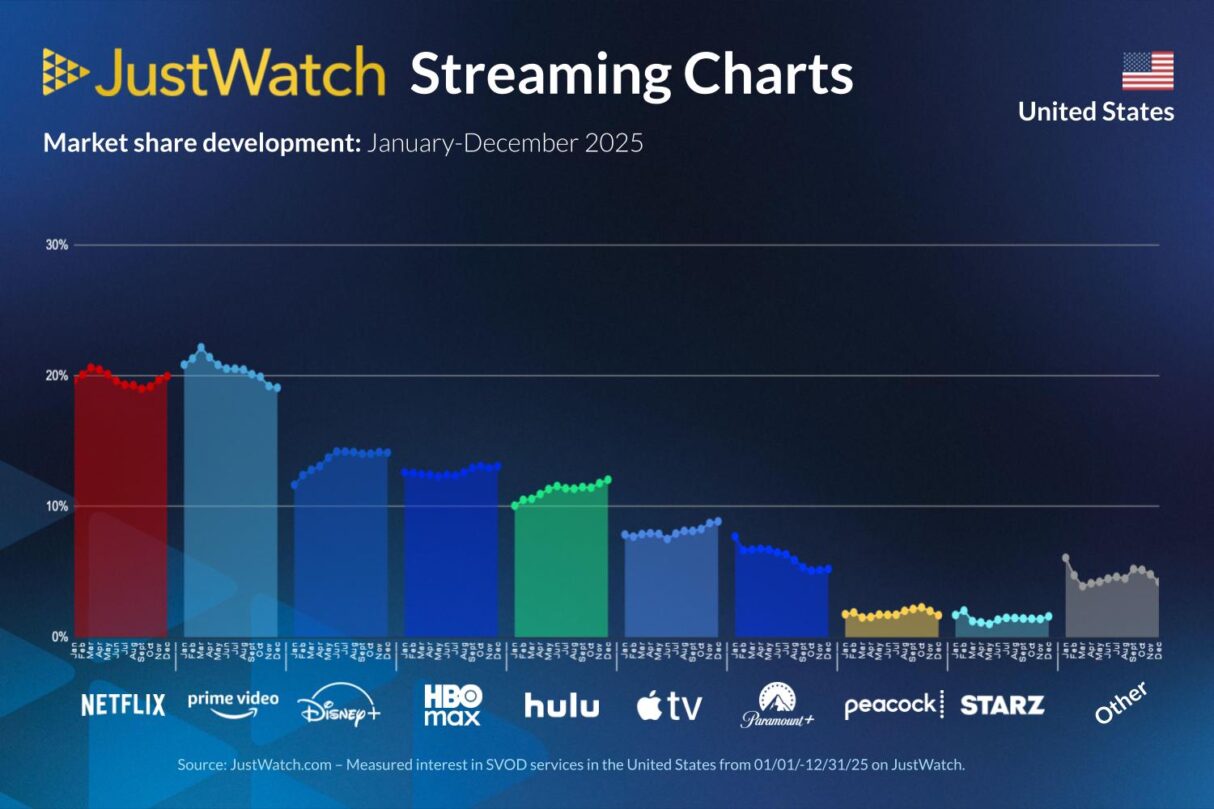

- New US market leader: Netflix (20%) overtook Prime Video (19%) in the last quarter of 2025, according to data released by JustWatch

- Increasing competition in the SVOD market: Netflix and Prime Video still lead the U.S. market, but both lost ground to mid-tier platforms in 2025. Netflix declined by 1 pp year-over-year, while Prime Video fell by 3 pp.

- Biggest winners of 2025: Disney+ (14%), Apple TV+ (9%), and other services (5%) each gained 2 pp over the year. Disney+ is now the third-largest SVOD platform by market share in the U.S., according to JustWatch data.

Market Development Snapshot

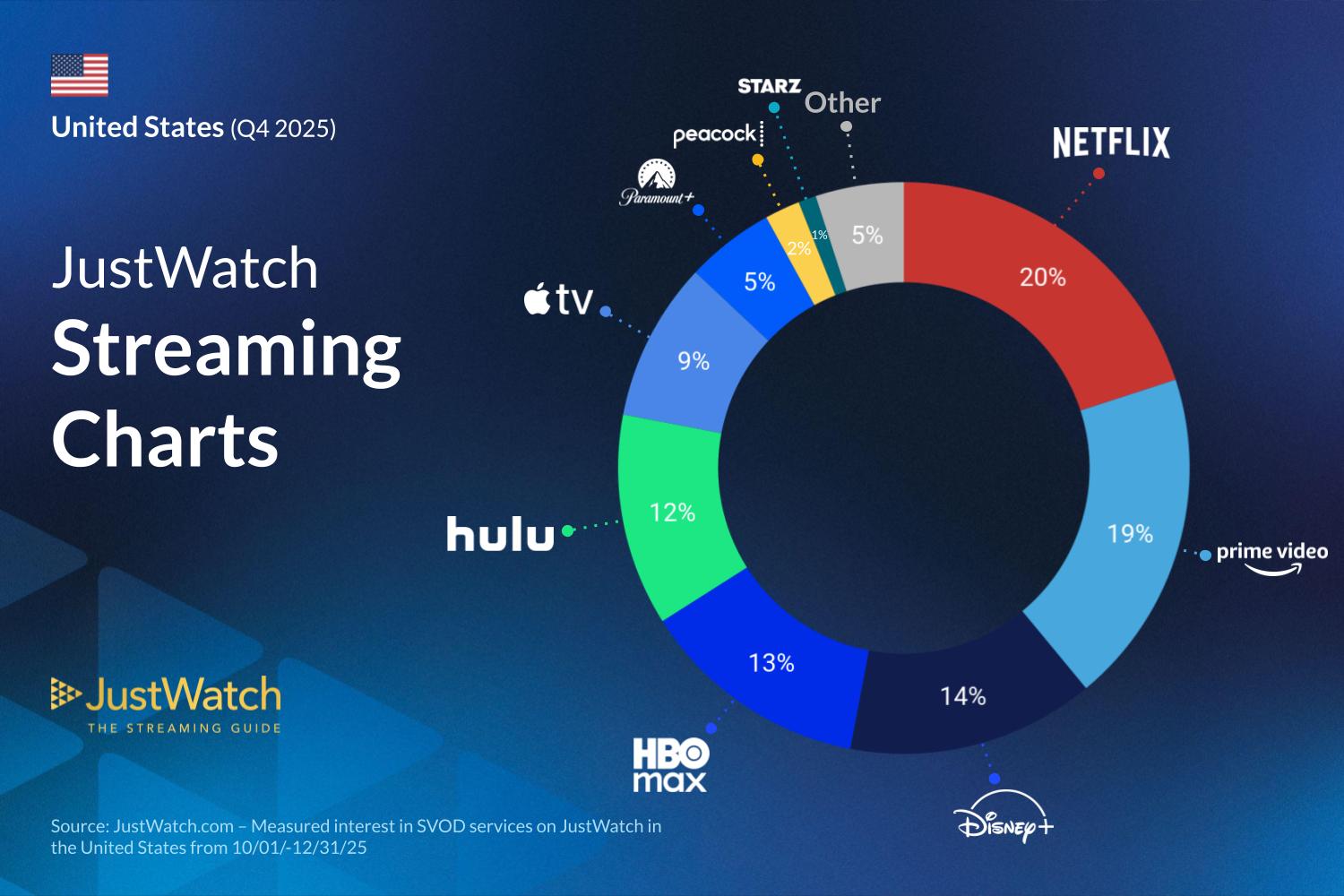

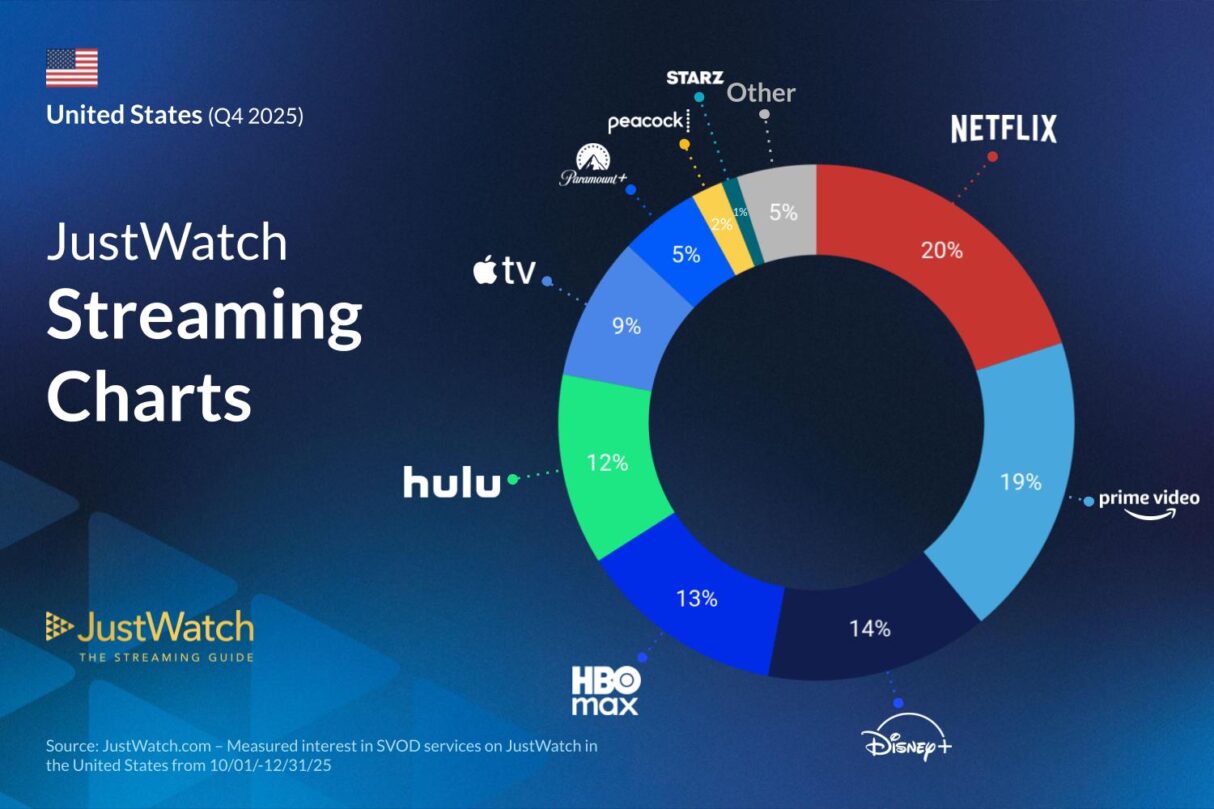

SVOD Market Shares in Q4 2025

The top two leaders in streaming this quarter are:

- Netflix – 20%

- Amazon Prime Video – 19%

Followed by Disney+ (14%), HBO Max (13%), and Hulu (12%), Apple TV+ (9%), Paramount+ (5%), Peacock Premium (2%), Starz (1%), and other services (5%).

Market Development Overview

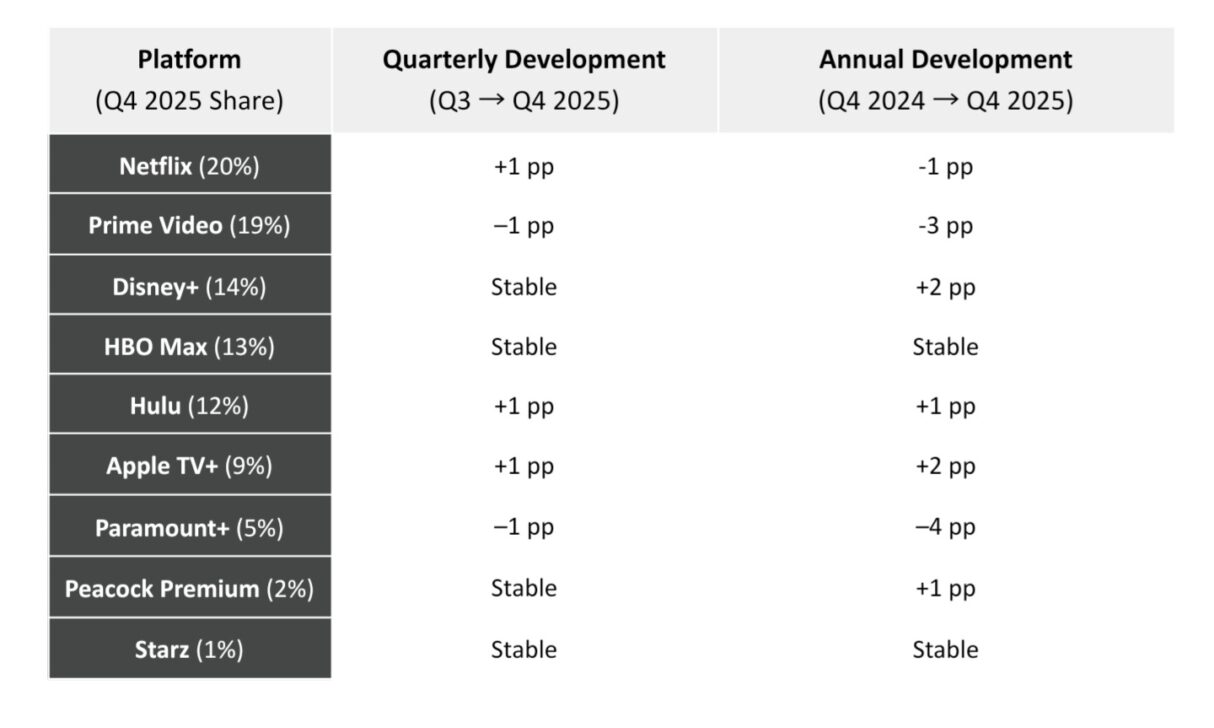

Netflix (20%) and Prime Video (19%)

- Quarterly development (Q3 → Q4 2025): Prime Video lost 1 pp this quarter, while Netflix gained 1 pp.

- Annual development (Q4 2024 → Q4 2025): Both Netflix and Prime Video lost traction over the year (-1 pp and -3 pp respectively).

- Market context: Netflix had a strong quarter across both movies and series, with exclusives such as Frankenstein and Stranger Things topping the weekly JustWatch U.S. Streaming Charts. Competition from mid-market platforms also intensified, with Disney+ and Apple TV+ each gaining +2 pp in 2025.

Disney+ (14%) and Hulu (12%)

- Quarterly development (Q3 → Q4 2025): Disney+ remained stable in Q4, while Hulu gained 1 pp with steady growth from October through December.

- Annual Development (Q4 2024 → Q4 2025): Disney+ grew 2 pp in 2025, one of the largest year-over-year increases, alongside Apple TV+. It surpassed HBO Max in March to become the third-largest streaming service in the US, according to JustWatch Data. Hulu gained 1 pp, making it fifth largest, trailing close behind HBO Max.

- Market context: Disney+ and Hulu performed strongly in 2025 on the strength of exclusive series such as Alien: Earth and Andor, alongside major releases like Lilo & Stitch (2025). In Q4, both services appeared less frequently in the JustWatch Streaming Charts. Meanwhile, Disney’s theatrical slate gained momentum with Zootopia 2 and Avatar: Fire and Ash.

HBO Max (13%) and Apple TV+ (9%)

- Quarterly development (Q3 → Q4 2025): HBO Max held its place this quarter and remained steady at 13%. Apple TV+ gained 1 pp.

- Annual development (Q4 2024 → Q4 2025): HBO Max retained its base in 2025, however, it lost its top three position to Disney+ in Q2. Apple TV+ saw an increase of 2 pp, as the platform grew in mainstream popularity in 2025.

- Market context: Both Apple TV+ and HBO Max performed strongly in terms of title popularity in 2025, according to the JustWatch Streaming Charts. Apple TV+’s top-performing titles included Severance, and in Q4, Pluribus also ranked highly. HBO Max likewise saw strong engagement across both movies and series, led by The Last of Us as its most popular title of the year, alongside films such as Sinners.

Paramount+ (5%), Peacock Premium (2%), Starz (1%), and Other Platforms (5%)

- Quarterly development (Q3 → Q4 2025): Paramount+ lost 1 pp from Q3 to Q4, as some of its main competitors pulled ahead. Peacock Premium and Starz remained stable, while other platforms grew by 1 pp.

- Annual development (Q4 2024 → Q4 2025): Paramount+ saw an annual decrease of 4 pp from 2024 to 2025. Peacock Premium grew 1 pp, while Starz remained stable. Other platforms saw a decrease of 2 pp in 2025.

- Market context: Paramount+ saw some volatility early in the year, potentially linked to the conclusion of Yellowstone, which aired its series finale in late 2024. However, the platform also saw strong performance from certain exclusive titles, including MobLand, South Park, and its release of The Naked Gun, as per JustWatch’s Streaming Charts.

SOURCES:JustWatch