A new analysis from Digital i reveals that blockbuster franchises and family-friendly titles are proving to be the unsung heroes of streaming retention.

Across Netflix, Disney+, Prime Video, and HBO Max, light viewers, those who watch infrequently and are most at risk of unsubscribing, are more likely to stick around for familiar, low-friction content than for critically acclaimed prestige dramas. Disney+’s Hocus Pocus 2 and HBO Max’s Flow are prime examples, attracting over a third of viewers from this at-risk segment, highlighting how strategic content selection can stabilize subscriptions in a competitive streaming landscape.

Digital i defines light viewers as the bottom third of measured accounts as ranked by total viewing time (48 mins per day or less on Netflix; 18 mins per day or less on HBO Max; 12 mins per day or less on Prime Video; 11 mins per day or less on Disney+, during the measured period).

Digital i ranked titles viewed on these four streaming platforms in the U.S., UK, France, Italy, Germany, Spain, Poland, the Netherlands, Denmark, Norway, Finland, and Sweden during 2025 by the highest percentage of light viewers among the total reach. The results revealed a consistent pattern: known franchises, movies and other low-friction entertainment disproportionately serve this audience across streaming platforms.

Movie magic

On Disney+, titles such as Hocus Pocus 2 (35.5% of 3.0m views to this film in 2025 were from light viewers), Hamilton (33.4% of its 3.1m viewers) and Marvel superhero movie Deadpool & Wolverine (32.0% of its 3.1m total reach) ranked among the strongest performers with light viewers last year. This was despite not delivering the streaming platform’s highest overall reach, demonstrating how blockbuster IP can act as a churn safety net.

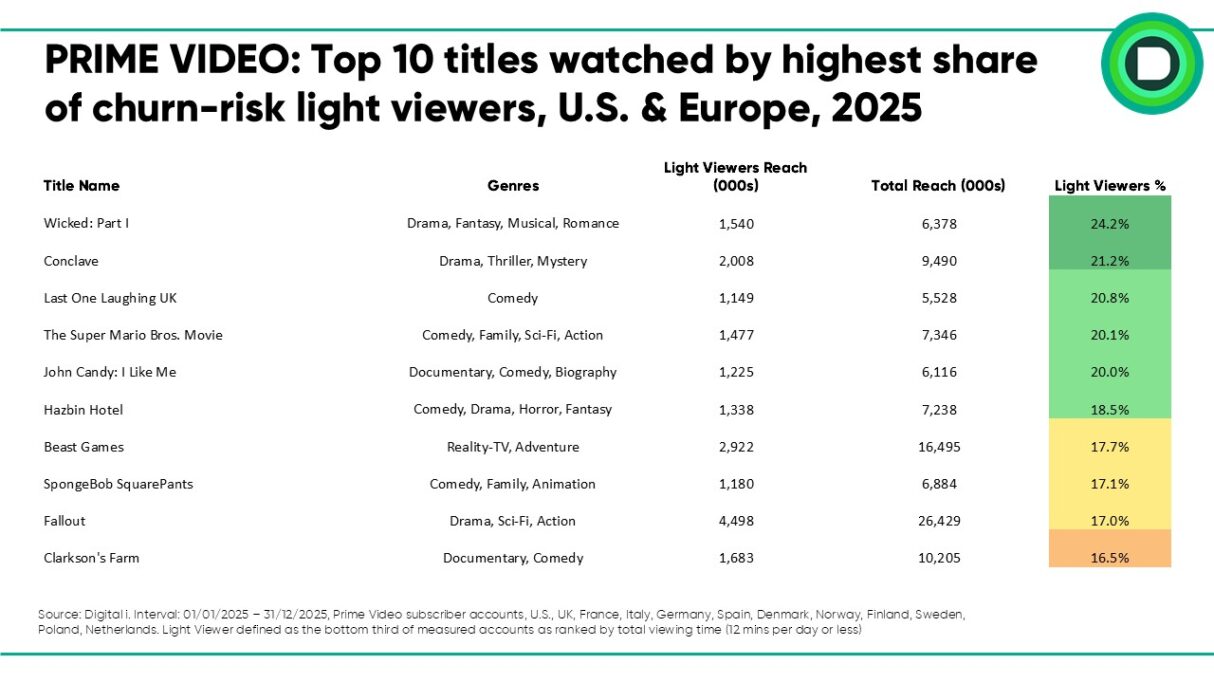

A similar trend was evident on Prime Video, where the films Wicked: Part I (24.2% of 6.4m), Conclave (21.2% of 9.5m) and The Super Mario Bros. Movie (20.1% of 7.3m), and the light-entertainment show Last One Laughing UK (20.8% of 5.5m), all ranked highly among light viewers, suggesting a stabilising role in subscriber retention.

While bundling Prime Video with its Amazon Prime retail service provides unique churn reduction benefits, our data shows that high-intent, familiar IP is still required to move passive subscribers into active, engaged viewers. It also explains the typically lower density of light viewers on the service.

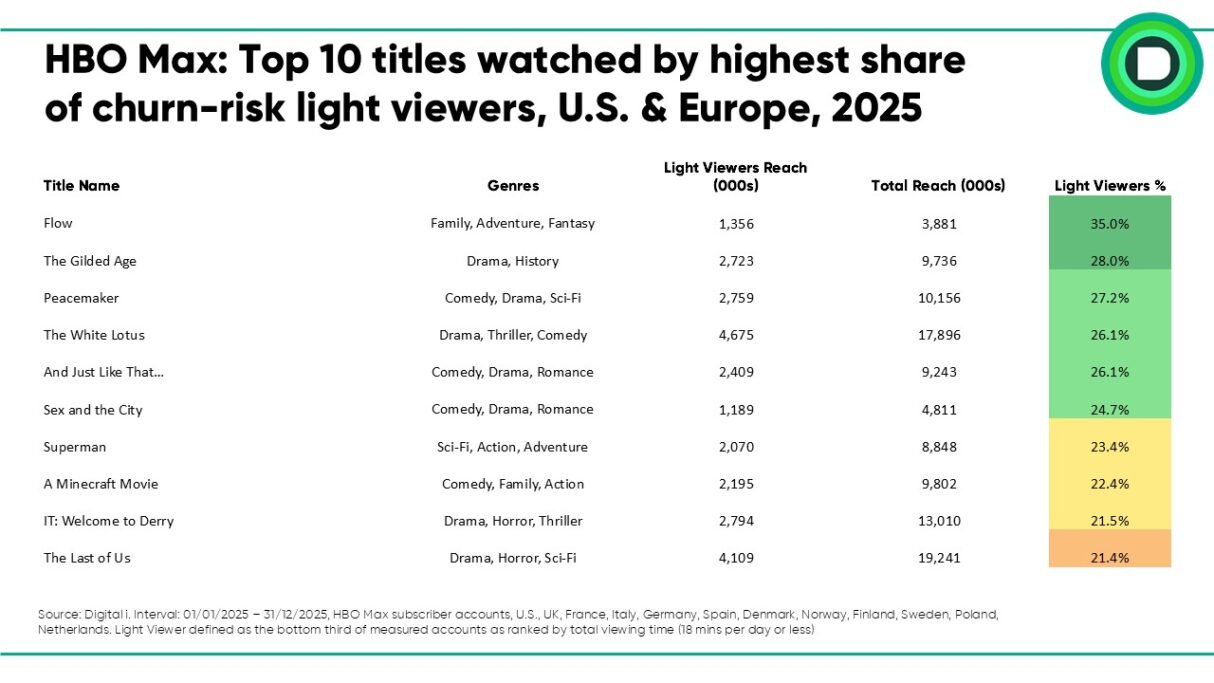

The reach vs. retention gap was most visible on HBO Max streaming platform. While critically acclaimed prestige hits like The Last of Us reached a massive 19.2m viewers, only 21.4% of that audience were light viewers. In contrast, the animated film Flow reached a smaller audience of 3.9m but captured a far higher density of churn-risk users at 35.0%.

Live sports as subscription driver

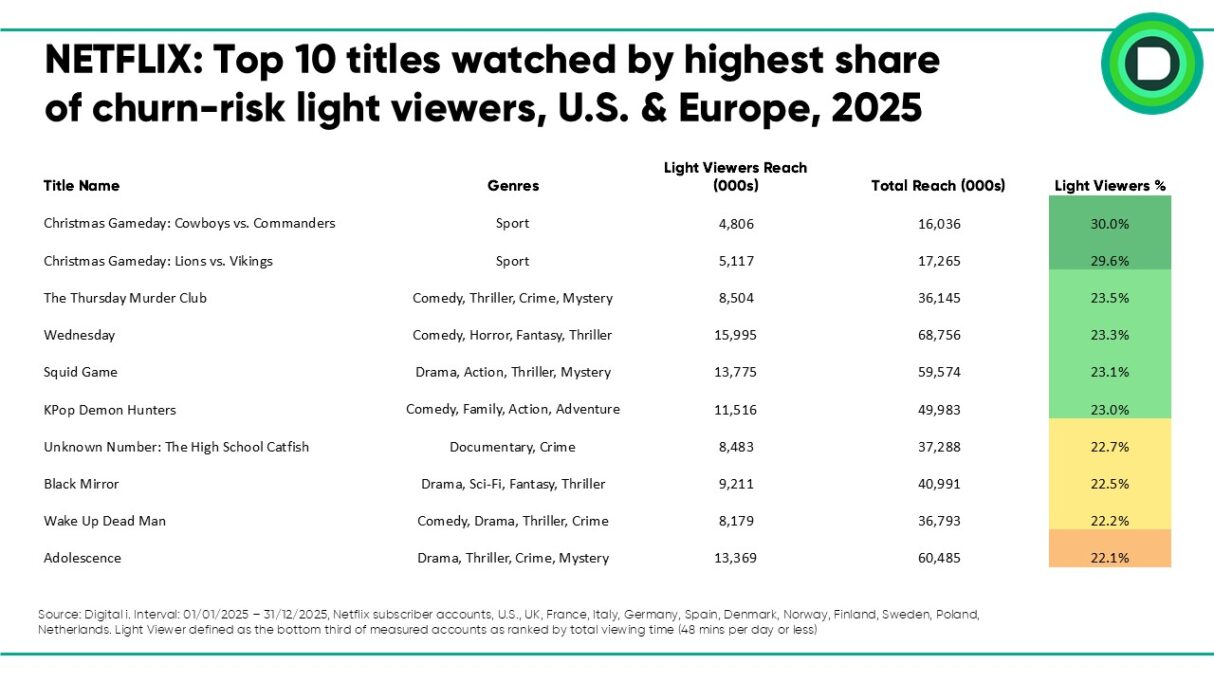

Meanwhile, Netflix’s NFL Christmas Gameday events demonstrated the power of live sports to attract infrequent users at scale, with the two games reaching a combined total of over 33m viewers, of which roughly 30% were light viewers.

This one-off spike provides a perfect hand-off to returning franchise dramas like Wednesday (23.3% light viewers) and Squid Game (23.1%), which maintain engagement across their massive 68.7m and 59.5m respective reach.

This also points to another trend – live sport acting as a subscription driver for streaming platforms, bringing in light viewers, who must then be captured by franchise content to prevent churn.

“The content that prevents churn is not always the content that dominates headlines or breaks overall reach records,” commented Digital i analyst Elena Mozzato. “Our 2025 analysis shows a clear ‘reach vs. retention’ gap.

“While critically acclaimed hits like The Last of Us draw massive audiences, it is the ‘low-friction’ titles – the familiar franchises and theatrical blockbusters – that disproportionately capture light viewers. These titles act as subscription stabilisers; by reducing decision friction for infrequent users, they provide a consistent reason to stay subscribed between major prestige releases.”