Content Americas 2026 has started with its first session: The Future Content Trends Report.

Speakers were OMDIA’s Head of Media and Entertainment Maria Rua Aguete, Parrot Analytics’ VP of Applied Analytics Alejandro Rojas, Plum Research’s Research Director Jonathan Broughton, and Fabric’s Data, Origin Nexus, and Origin Insights SVP Luciano Zarlenga.

The Global Media & Entertainment Industry Enters 2026 on Strong Footing: Video, Microdramas and Shifting Power Dynamics

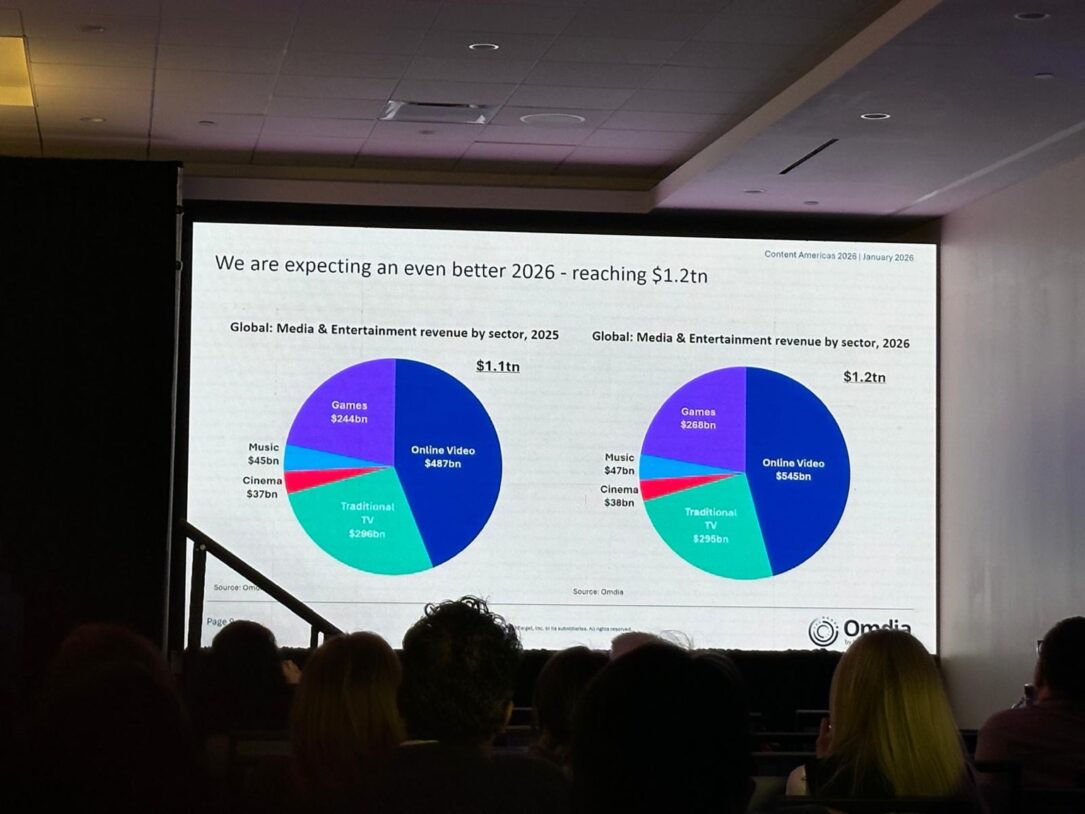

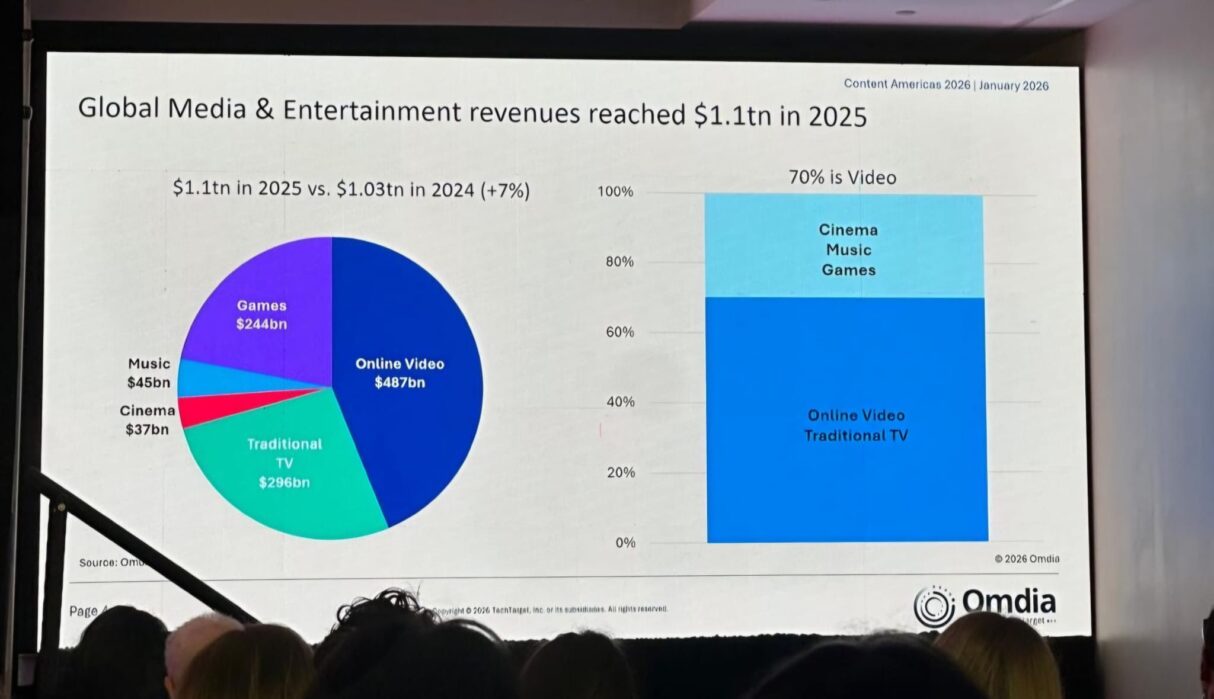

The global media and entertainment industry closed 2025 with a market value of $1.1 trillion, and expectations for 2026 are even higher. According to data from Omdia, the sector is projected to reach $1.2 trillion this year. At the center of this growth is a clear driver: video content.

As of 2025, nearly 70% of global media revenues come from video. When online video and traditional television are combined, they form the backbone of the industry. Online video alone accounts for $487 billion, making it the largest segment, followed by gaming at $244 billion. Music and cinema, by comparison, represent much smaller shares of the overall market.

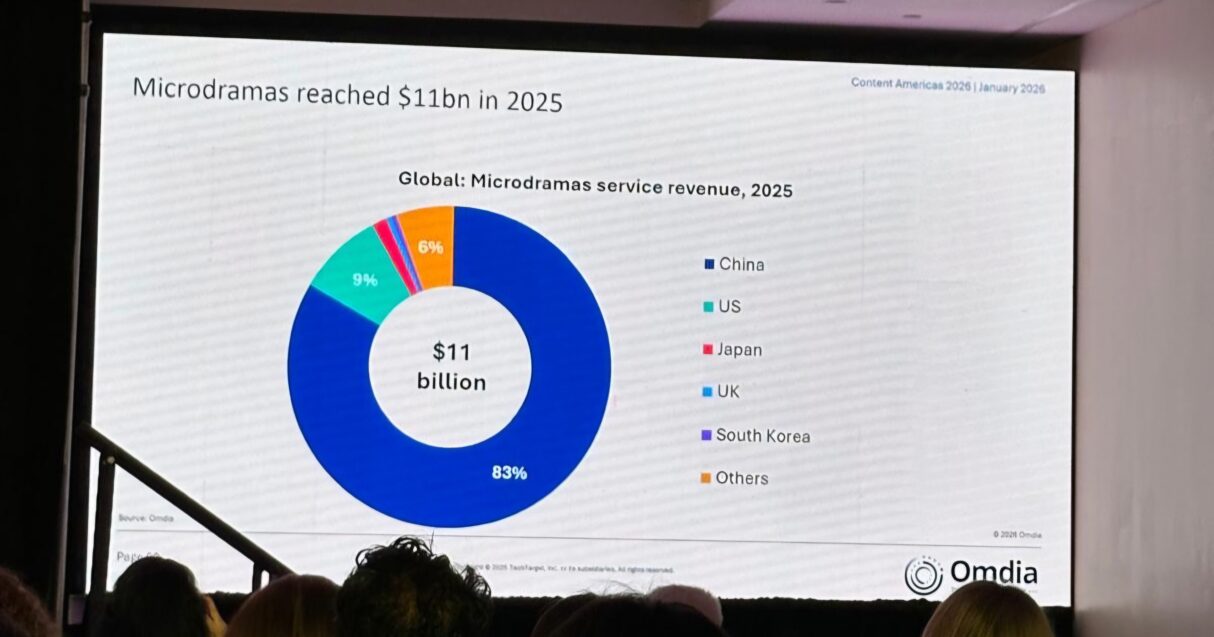

The Rise of Microdramas: An $11 Billion New Economy

One of the most striking developments of 2025 has been the rapid rise of microdramas. Designed for mobile-first consumption, short-form serialized storytelling has grown into an $11 billion market in just one year. China dominates the segment, generating 83% of global microdrama revenue, while the US follows with a 9% share.

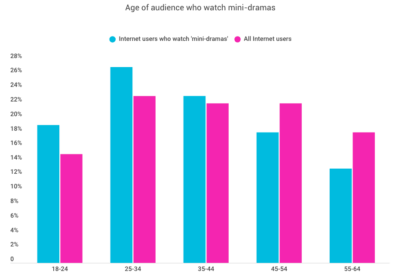

This distribution highlights that microdramas are no longer a niche trend but a scalable business model, particularly in Asia. With lower production costs and high-volume output, the format aligns perfectly with younger audiences’ viewing habits and shrinking attention spans, making it increasingly attractive for platforms seeking new revenue streams.

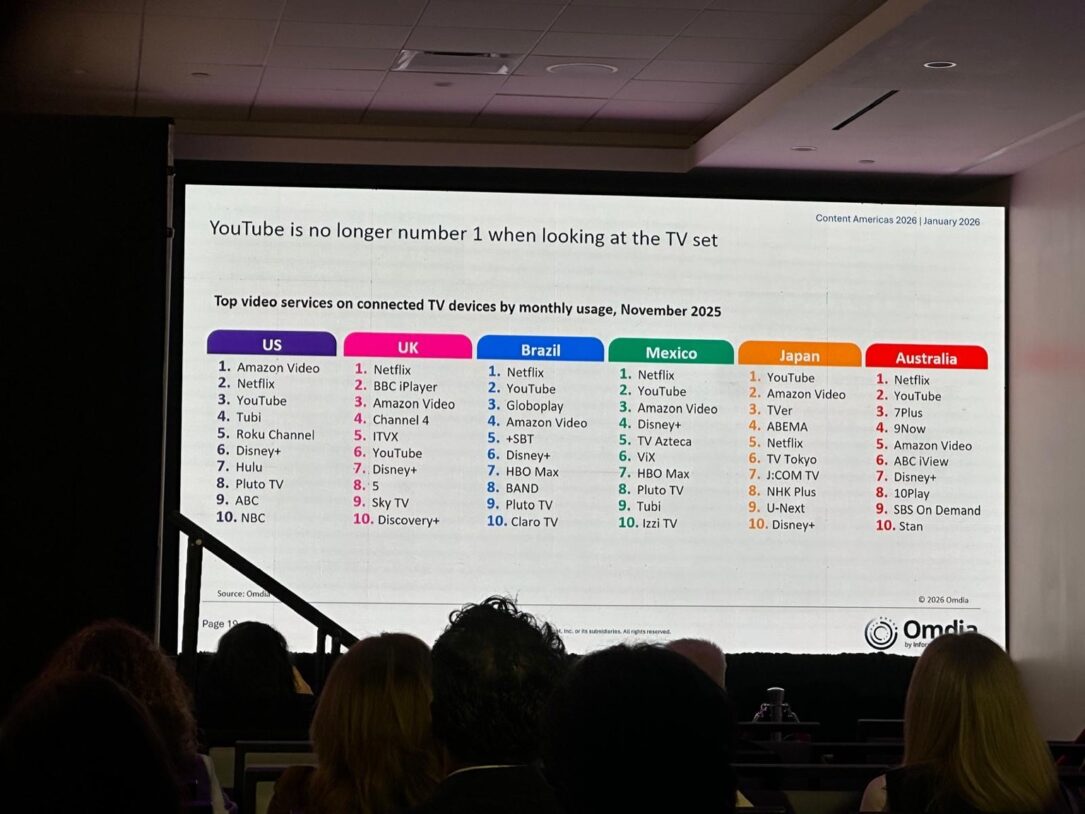

Has YouTube Lost Its Crown on the TV Screen?

Another major shift is taking place in connected TV (CTV) viewing habits. Long considered the dominant platform on television screens, YouTube is no longer the number one service in every market. As of November 2025:

- Amazon Video leads in the US.

- Netflix ranks first in the UK.

- Netflix also dominates in Brazil and Mexico.

- YouTube remains strong in Japan, though competition is intensifying.

This data signals the end of the “single global winner” era. Platform leadership is now shaped by regional dynamics, local content strategies and market-specific user behavior.

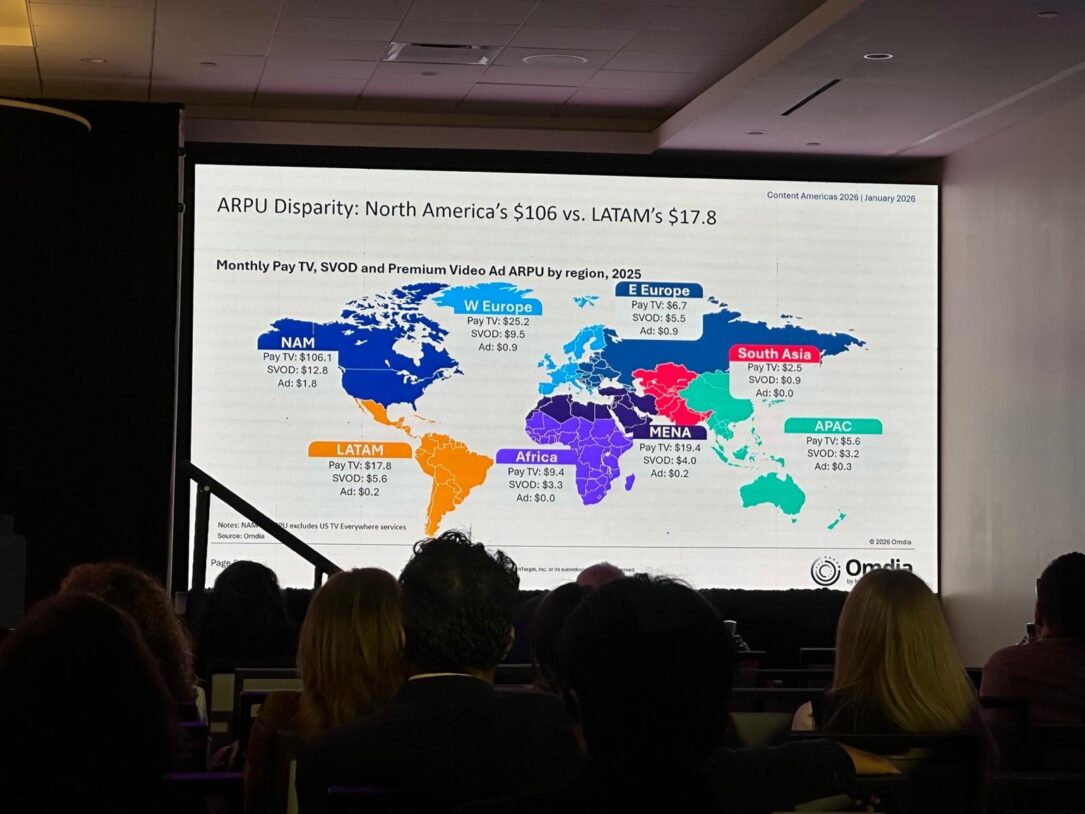

Revenue Inequality: Same Content, Very Different Value

ARPU (average revenue per user) figures reveal one of the industry’s most striking realities. In North America, monthly media ARPU stands at $106, while in Latin America it drops to just $17.8. Europe, MENA and APAC fall somewhere between these two extremes.

This gap explains why global platforms pursue radically different strategies across regions. The same content can carry vastly different economic value depending on geography, reinforcing the growing importance of advertising models, pricing flexibility and local productions.

Looking Ahead to 2026: A Video-Centric Future

Projections for 2026 indicate that most of the industry’s growth will come from online video and gaming. Online video revenues are expected to rise to $545 billion, while traditional TV continues its gradual but steady decline.

In short, the future of media and entertainment is becoming shorter, more mobile, more regional and increasingly video-driven. The rise of microdramas, the erosion of YouTube’s dominance on TV screens and widening regional revenue gaps all point to a sector undergoing a complex, multi-layered transformation.