Fabric has announced its role as Data Partner of the Dubai International Content Market (DICM) 2025. As part of this collaboration, the company has released a new report on Türkiye’s streaming ecosystem, suggesting that the market is entering a new phase of transformation.

The report, titled Türkiye: Local Growth in a Globalized Streaming Ecosystem, highlights several key trends:

- Digital Viewership on the Rise: In Q1 2025, 73% of Turkish households consumed online content. Although this figure represents a 4% year-over-year increase, it remains 8 percentage points below the EMEA regional penetration (81%). Within the region, Norway leads in digital viewership at 89%, while South Africa reports the lowest level at 69%. This highlights Türkiye as a developing streaming market with room for growth.

- Global Platforms Lead, but Local Players Gain Ground: Netflix (42%), YouTube Premium (32%), and Prime Video (29%) remain the top three services by penetration. Still, four of the top 10 platforms are domestic: Exxen, BluTV, Tivibu GO, and D-Smart GO. A major milestone in this landscape is the BluTV-HBO Max merger, effective April 2025. This marks the official entry of HBO Max into the Turkish market through a well-established local brand. Prior to the merger, HBO Max had no presence in the country. At a launch event, Warner Bros Discovery announced 3 new Turkish local originals, set to debut on HBO Max. Anatomy of Chaos, Jasmin, and Feride. This strategic move gives HBO Max access to BluTV’s user base and original content library, reshaping the competitive dynamics between global and domestic platforms.

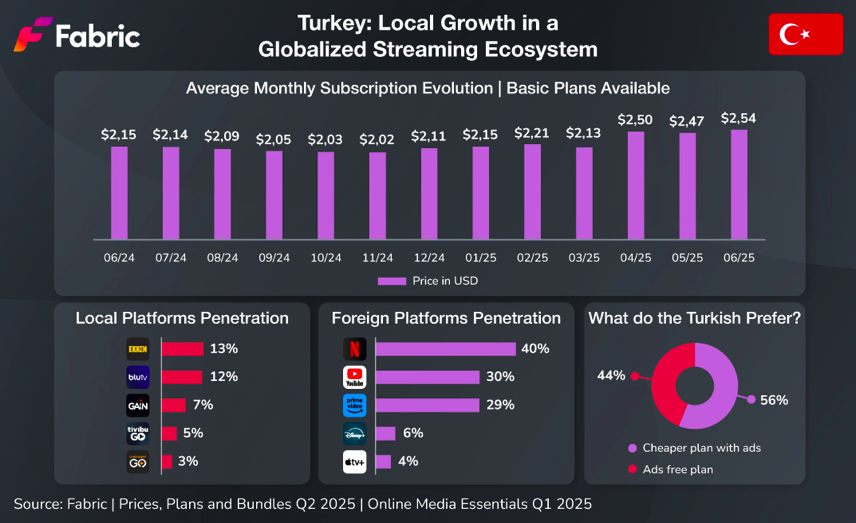

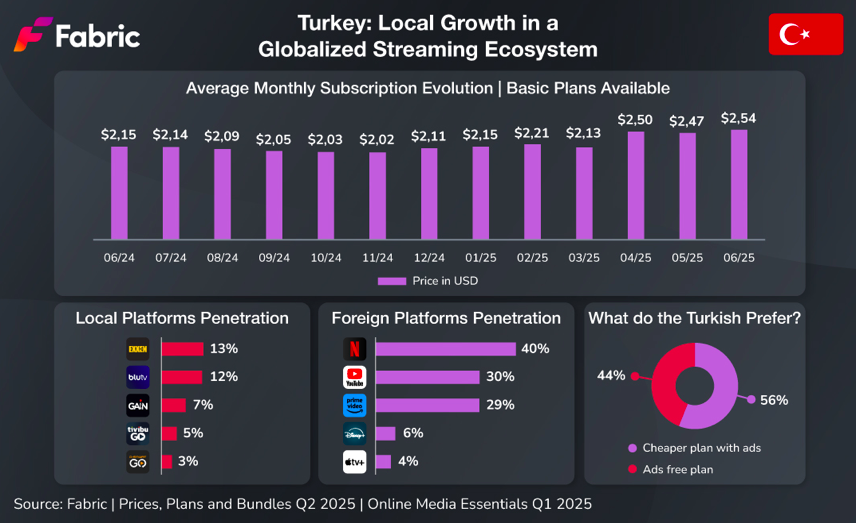

- Flexibility as a Strategy in a Price-Sensitive Market: Free with Ads remains the most consumed model at 67% household penetration, but subscription models are growing faster. In just 12 months, adoption rose from 46% to 58%, a 26% increase. This signals a growing willingness to pay for content, despite an 18% average price hike in the past year. That said, Türkiye continues to offer some of the lowest subscription prices worldwide with Prime Video: USD 0.98, 85% below the EMEA regional average, Crunchyroll: USD 1.25, 78% below the regional average, Netflix: USD 4.77, 23% below the regional average, and HBO Max: USD 5.75, 36% below the regional average. In response to changing user expectations, some platforms have introduced hybrid models. Both Disney+ and Tivibu GO now offer ad-supported subscription plans. They are currently the only two platforms in Türkiye with this option, aligning with consumer behavior: 56% of Turkish households prefer lower-priced plans with ads.

- Original and Local Content: Still Limited, But Growing: Netflix dominates with over 4.5K original titles in the country, including more than 60 Turkish originals. In Q2 2025, all 5 of the most-watched original titles in Türkiye came from Netflix. Leading titles include: When Life Gives You Tangerines (South Korea, 2025), Adolescence (United Kingdom, 2025), The Eternaut (Argentina, 2025), The Residence (U.S.A., 2025), Apple Cider Vinegar (Australia, 2025). In contrast, local platforms offer a more limited volume of originals: Gain: 103 original titles and Puhutv: 15 original titles. However, Fabric’s data shows that 2 of the top 5 most-viewed series in Türkiye in Q2 2025 were national productions: The Fall of the King (Kral Kaybederse) (2025), available on Netflix, Puhutv and D-Smart Go, and Reminder (2025), a Disney+’s original.

The report suggests that Türkiye’s streaming landscape is in transition. Türkiye’s streaming ecosystem is currently defined by the coexistence of global giants and growing local services. The HBO Max-BluTV merger, the rise of subscription models, and steady digital adoption suggest the country is moving toward a more mature market phase.

However, challenges remain. The local offer must consolidate to compete with international catalogs. Investment in original content production and hybrid pricing models will be key for domestic platforms looking to scale in a dynamic and competitive environment.