The European Audiovisual Observatory has released a new report on investment in European original content between 2014 and 2024. Drawing on Ampere Analysis data, the study provides an overview of production investment by broadcasters and streamers in original European content.

Key findings:

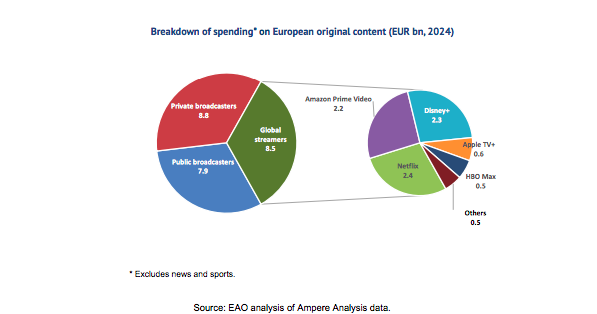

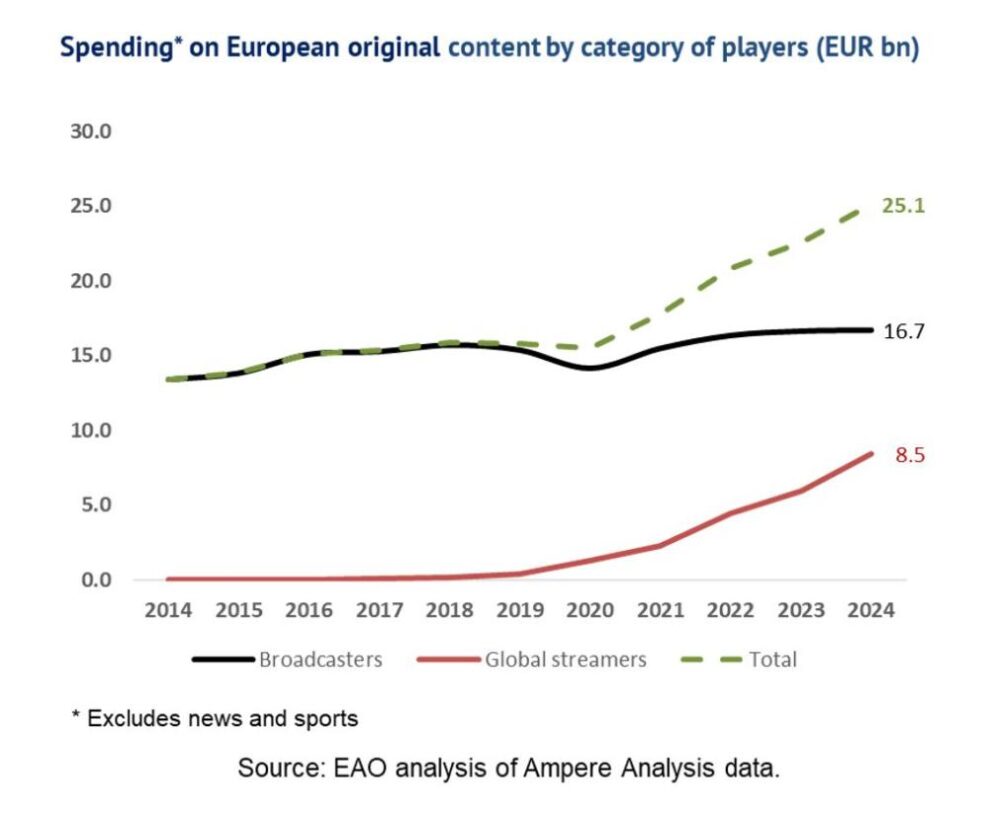

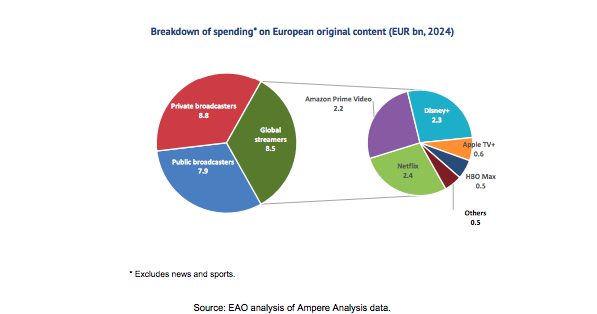

According to the report, total spending on European original content (excluding news and sports rights) reached €25.1 billion in 2024, with two-thirds coming from the broadcasters and one-third (8.5 billion) from global streamers.

For the purpose of the study, Europe refers to the EU27 countries, as well as Albania, Armenia, Bosnia and Herzegovina, Iceland, Montenegro, North Macedonia, the Republic of Moldova, Norway, Serbia, Switzerland, Türkiye, the United Kingdom, and Ukraine.

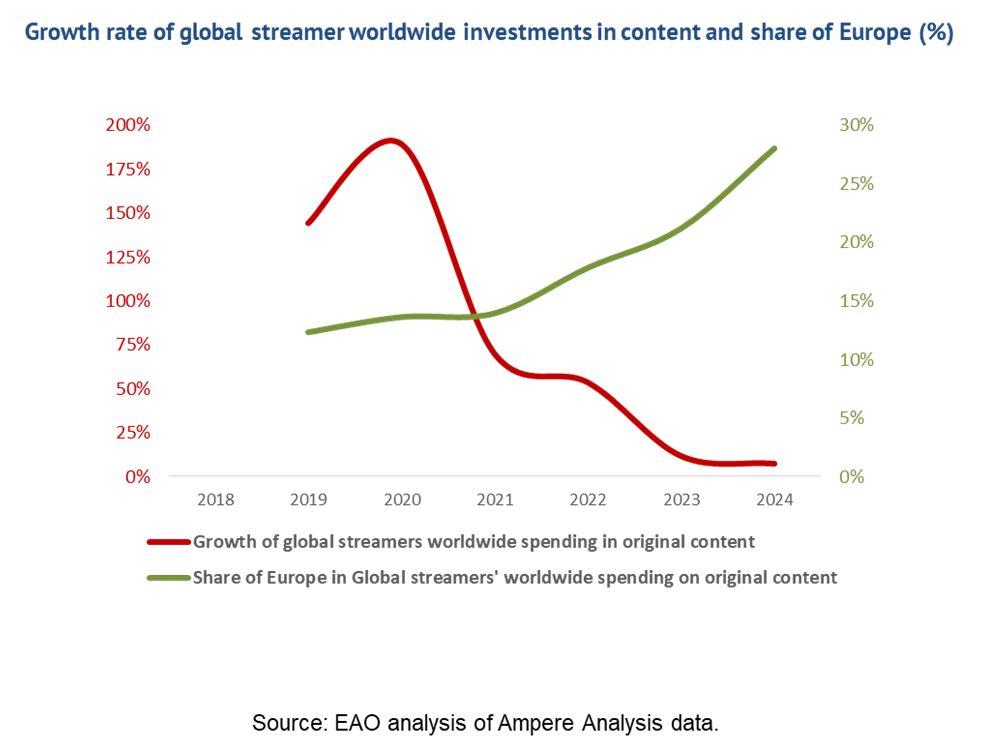

Whereas global investments in content by major streaming services are plateauing, the proportion of investment dedicated to European original content is increasing at the expense of US content. Disney+ in particular has considerably increased its investment in European original content.

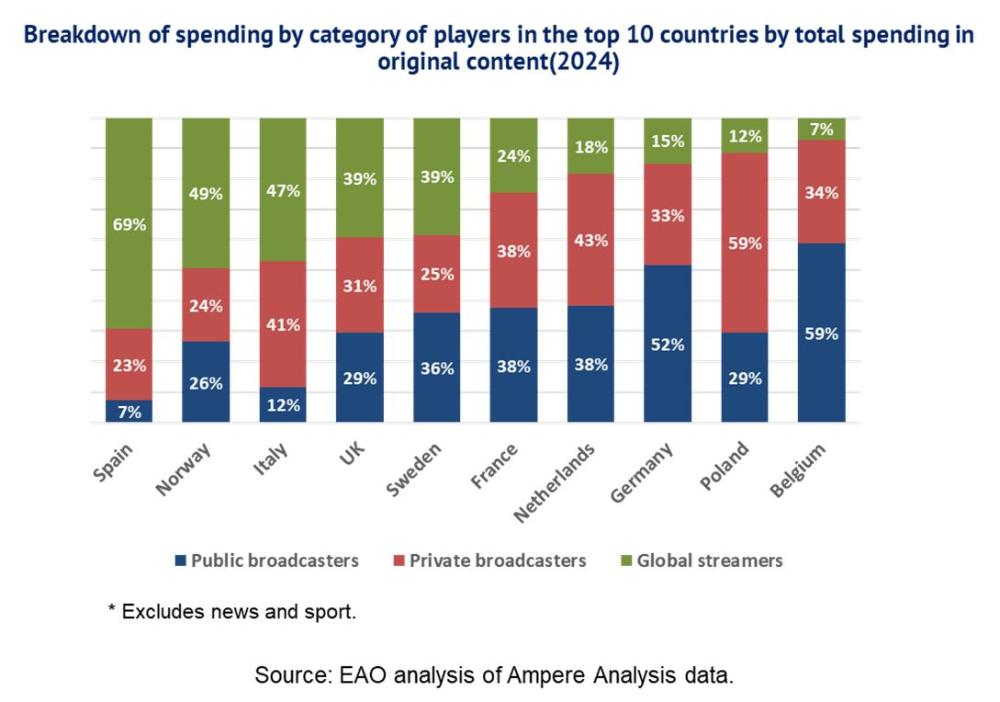

The balance between broadcasters and streamers varies widely from country to country. In markets such as France, the Netherlands, Germany, and Poland, broadcasters play a more important role in the production of European original content than in Spain, Norway, and Italy, where global streamers account for nearly 50% or more of total spending.

In 2024, Netflix, Disney+, and Amazon Prime Video each spent over EUR 2 billion on original European content. Together, they accounted for over 80% of global streamers’ spending on European content.

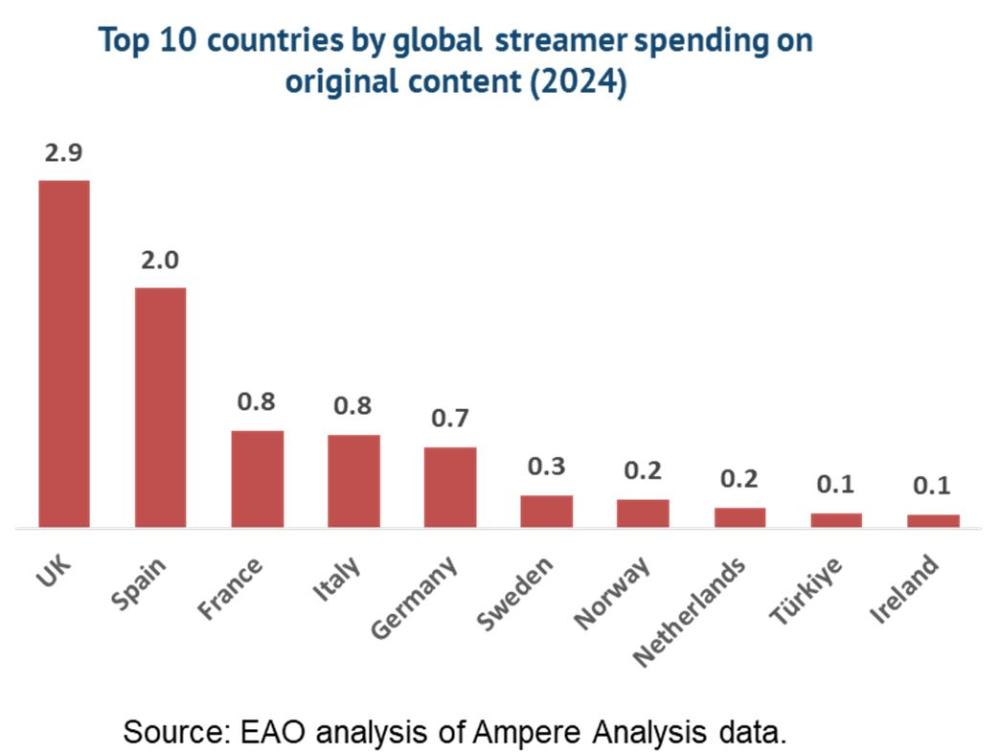

Streamer spending is also concentrated geographically, with the United Kingdom and Spain together capturing 58% of these investments. Meanwhile, Germany and, to a lesser extent, France, the Netherlands, and Poland appear to be lagging behind in their ability to attract comparable levels of global streamer investment.

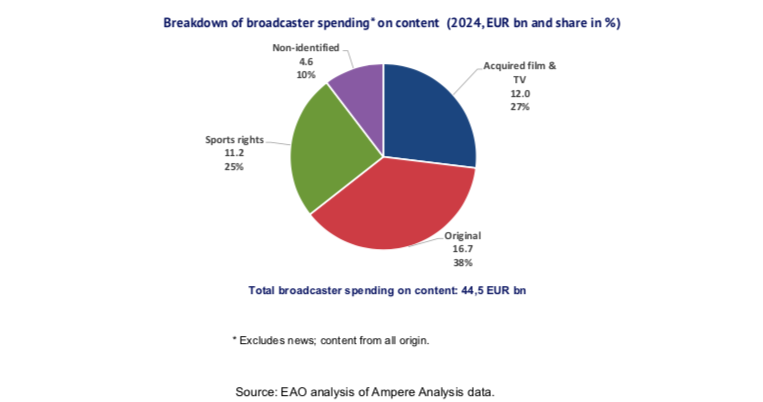

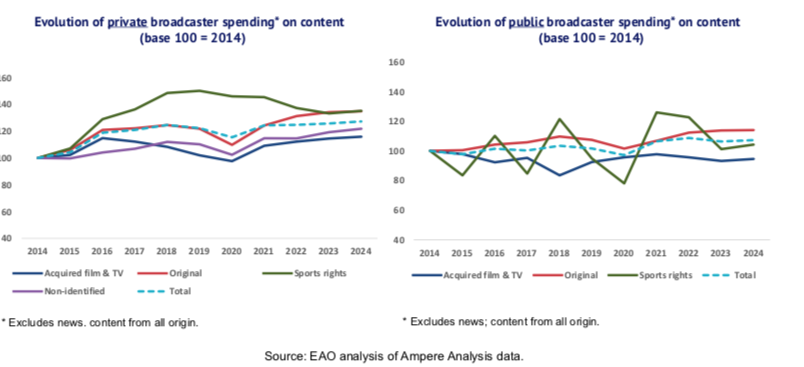

Beyond original productions, the report also looks at overall content spending. In 2024, broadcasters allocated €44.5 billion to programming, with original content representing the largest share at 38%, followed by acquired film and TV (27%) and sports rights (25%)

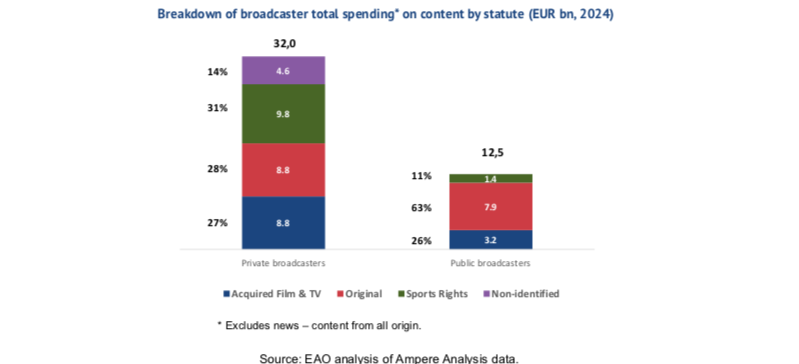

The breakdown shows important structural differences: sports rights dominate the budgets of private broadcasters, while public broadcasters dedicate a larger share to originals. Despite these pressures, both private and public broadcasters increased their investment in original programming, pointing to a shift away from acquired content.

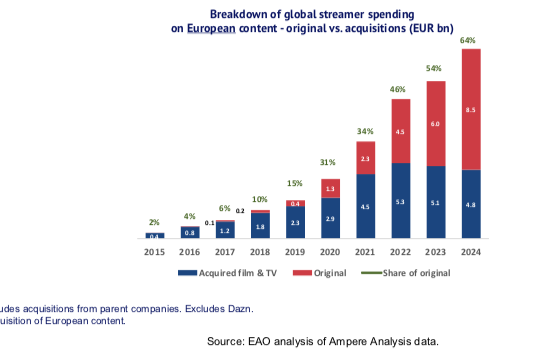

For global streamers, spending has grown steadily across both acquisitions and original productions. Until 2022, acquisitions made up the majority of their European content budgets, but since 2023 originals have taken the lead. By 2024, original productions represented 64% of streamers’ total European spending, compared with less than half just two years earlier

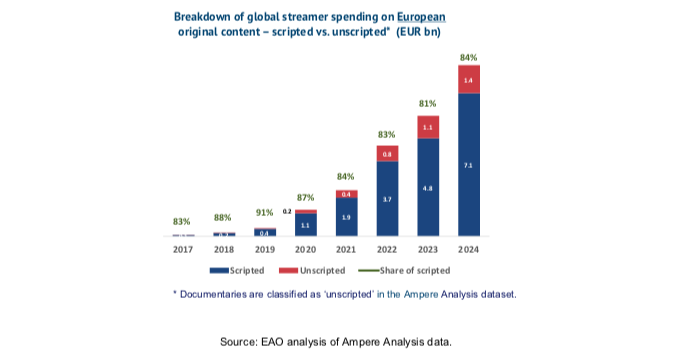

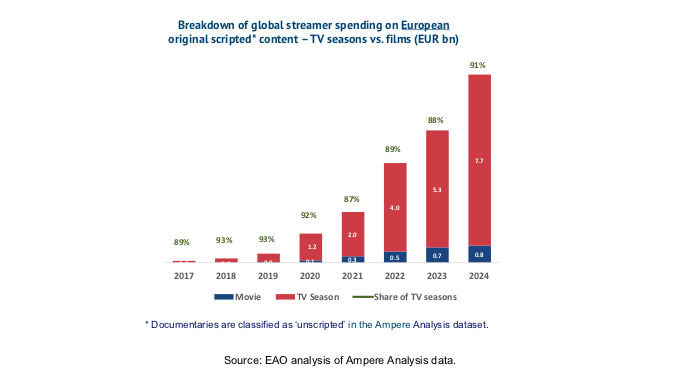

Spending on unscripted programming has increased, but scripted programming still accounts for the lion’s share of global streamer spending. And among scripted content, series account for about 90% of global streamer investments.